|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Comprehensive Guide to Understanding Pet InsurancesIn recent years, the concept of pet insurance has gained significant traction, capturing the interest of many pet owners who wish to secure the well-being of their beloved companions. While some may view it as an unnecessary expense, others consider it an invaluable safety net, ensuring their pets receive the best care possible without financial strain. This article aims to demystify pet insurance, providing insights into its benefits, potential drawbacks, and how to choose the best policy for your furry friend. What is Pet Insurance? Pet insurance, much like health insurance for humans, is a policy you purchase to cover unforeseen medical expenses for your pet. These policies can cover a variety of situations, from accidents and injuries to illnesses and even routine care, depending on the coverage level you choose. The idea is to mitigate the high costs of veterinary care, which can sometimes be overwhelming.

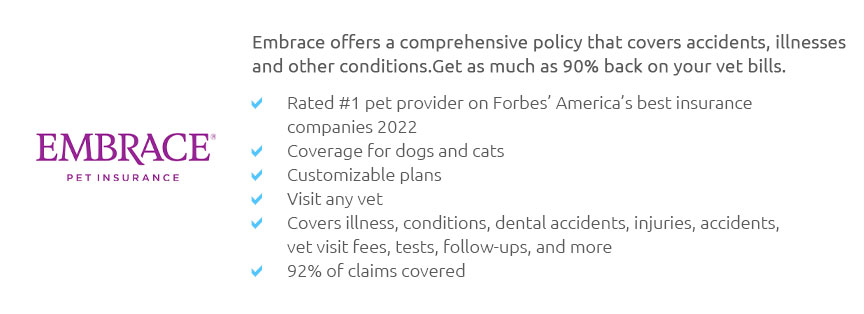

Choosing the Right Policy Selecting the right pet insurance policy can be daunting given the plethora of options available. It's essential to evaluate your pet's specific needs, your financial situation, and the potential health risks associated with your pet's breed. Comparing different insurers, reading customer reviews, and understanding the fine print are all crucial steps in making an informed decision. Consider the company's reputation, customer service, and claim process efficiency before committing. Conclusion Ultimately, pet insurance can be a worthwhile investment, providing peace of mind and financial protection against unexpected veterinary costs. While it may not be suitable for everyone, those who prioritize their pet's health and wish to avoid difficult financial decisions during emergencies may find it particularly beneficial. As with any insurance, it's about weighing the costs against the potential benefits and finding a balance that suits your lifestyle and your pet's needs. https://www.aspcapetinsurance.com/

Pet insurance is insurance coverage for your pet. It covers the eligible costs of treating accidents and illnesses. Helpful resources for pet parents. https://www.geico.com/pet-insurance/

Pet insurance can help manage health costs for your pets. Pet insurance is a specialized health insurance for your beloved pets. Get affordable care for your ... https://vcahospitals.com/know-your-pet/pet-insurance-for-dogs

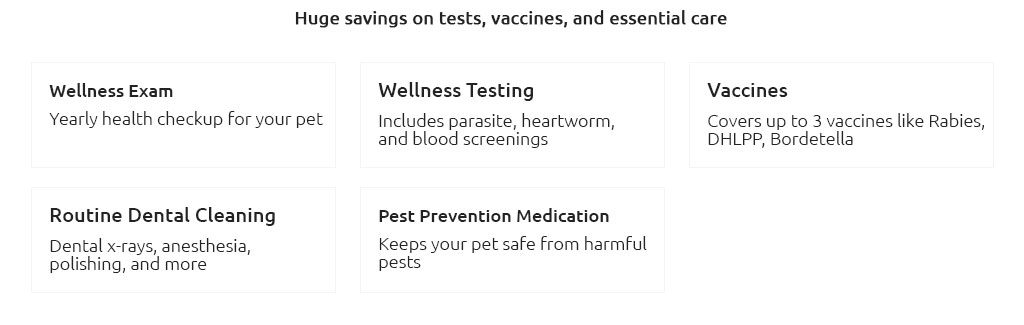

Pet health insurance policies are primarily designed to cover accidents and illnesses. A few companies offer additional coverage for routine vaccinations and ...

|